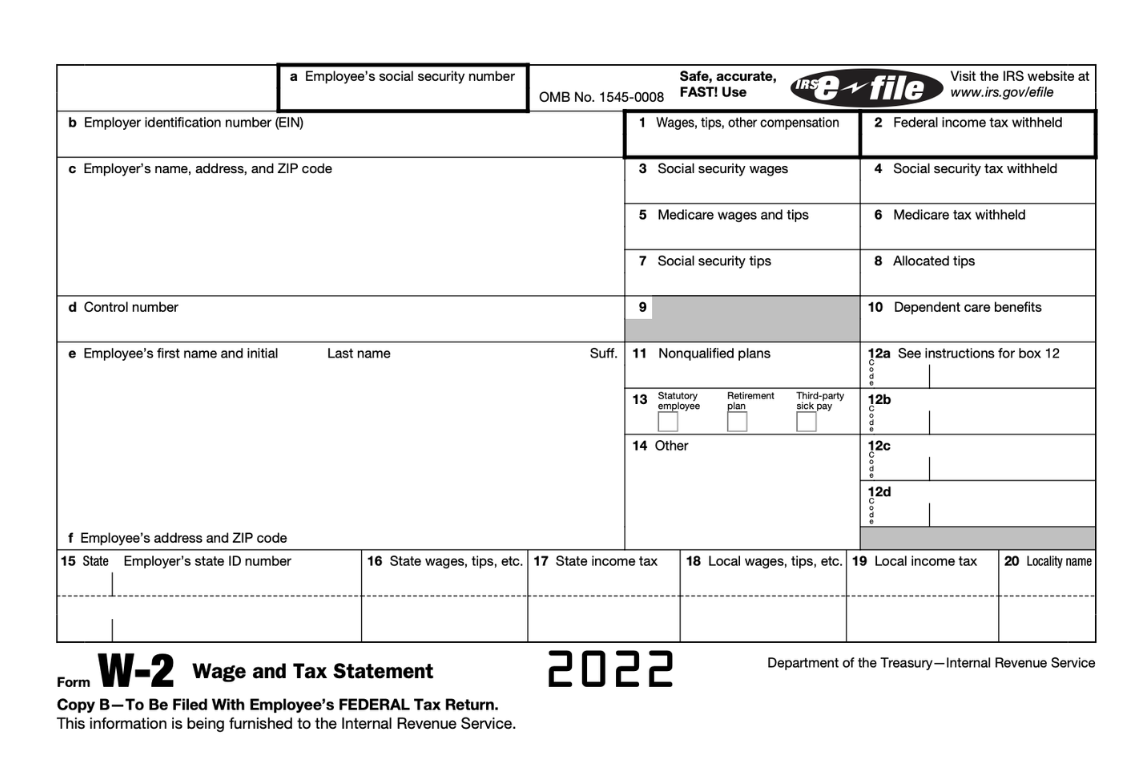

W2 online form is an essential document that taxpayers need to file their tax returns. It provides a detailed summary of your earnings and the taxes withheld throughout the year.

However, there can be instances where you may have lost or misplaced your W2 form or haven’t received it from your employer yet. Don’t worry! You can get a copy of your W2 online for free. In this article, we will discuss five ways to obtain your W2 form online.

Contact your Employer

The easiest and quickest way to get your W2 form is to contact your employer. According to the Internal Revenue Service (IRS), employers are required to provide a copy of the W2 form to their employees no later than January 31st.

If you have not received your W2 form, you can contact your employer and request them to provide you with a copy. In case you have moved to a new address, ensure to update your address with your employer to ensure timely delivery of your W2 form.

Use the IRS’s Get Transcript Tool

If you have contacted your employer, but they are not responding, you can use the IRS’s Get Transcript tool to request a copy of your W2 form online. The tool allows taxpayers to obtain a copy of their tax transcripts online.

To use this service, you will need to create an account on the IRS website, and the process of verifying your identity may take up to 15 minutes. Once your identity is confirmed, you can request a copy of your W2 form, which will be sent to you by mail.

Use a Third-Party Service

Several third-party services, such as TurboTax, H&R Block, and TaxAct, offer a free service to obtain your W2 form online. These services allow you to import your W2 information and file your taxes online.

You can also download a copy of your W2 online form from these services. However, these services may charge you a fee for additional services like filing your taxes. Ensure to read the terms and conditions before using these services.

Contact the Social Security Administration

If you require your W2 form for Social Security purposes, you can contact the Social Security Administration (SSA) to request a copy of your earnings statement. This statement includes information about your earnings and the taxes you paid.

You can request a copy of your earnings statement online, by phone, or by mail. Keep in mind that the earnings statement is not the same as your W2 form. It only includes a summary of your earnings and taxes paid.

File an Extension

If you have tried all the above methods, and still not able to obtain a copy of your W2 form, you can file for an extension with the IRS. Filing an extension will give you more time to obtain your W2 online form and file your taxes. You can file an extension by using Form 4868, Application for Automatic Extension of Time to File U.S. Individual Income Tax Return.

However, keep in mind that filing an extension only gives you more time to file your taxes, and not to pay your taxes. You must still estimate your taxes and pay any taxes owed by the original tax deadline to avoid penalties and interest.

Conclusion

Getting a copy of your W2 online form for free is not difficult. You can request a copy from your employer, use the IRS’s Get Transcript tool, use a third-party service, contact the Social Security Administration, or file an extension if you need more time. Ensure to keep your W2 form in a safe place once you receive it, to avoid having to request another copy in the future.